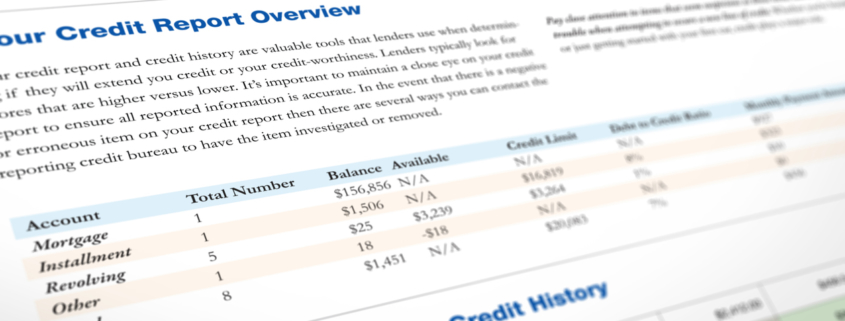

When you are thinking of hiring someone, you might want to get their credit report first. The credit report will not tell you the person’s credit score, but it will tell you about all the debts that person has incurred and whether they have paid back those debts or are in the process of doing so. The advantage of getting a credit check on a potential employee is that it lets you know how solvent they are. This is especially relevant if you are hiring them for a financial position. However, there are certain things you need to keep in mind when using credit reports for this purpose.

Permission

You can’t simply go ahead and ask for another person’s credit report. You need their written permission first. This is sensitive information and your potential employee wouldn’t like it if anyone could access it without clearing it with them. So make sure you do so.

Time Covered

The credit report will only contain information going back the last seven years. If there is other negative information regarding that person that is more than seven years old, then you will not have access to it.

Bankruptcy Information

You will not have access to bankruptcy information that is more than 10 years old. And you can’t decide not to hire someone based solely on their bankruptcy information because this is considered discrimination.

Inform the Candidate

You must tell the candidate if you are not hiring them because of something you read in the report. If you decide not to hire them for another reason, it’s ok. But if the reason is directly related to their credit report, then they have a legal right to know.

Provide a Copy

If the potential employee asks for a copy of their credit report, then you have to give it to them. You also need to give them a copy of the report if you decided not to hire them based on information in the report.

Learn More About Using Credit Reports

In short, a credit report can be an important tool to use when you’re hiring someone. But make sure you don’t misuse it in any way or you may be leaving yourself open to legal action. Contact us for more information.

Leave a Reply

Want to join the discussion?Feel free to contribute!